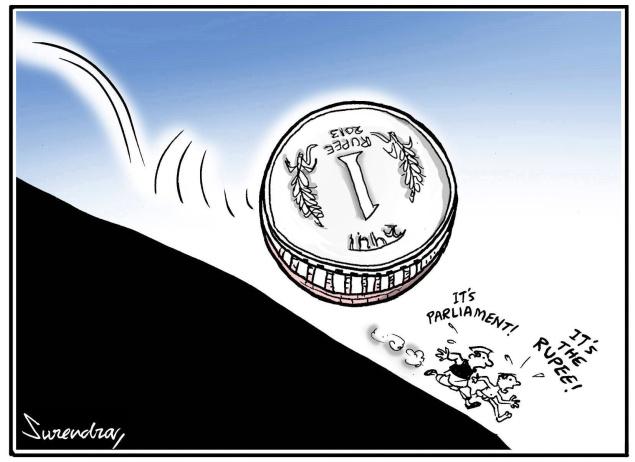

Indian rupee has plummeted to a record low falling more than 9.70% making it the worst performing currency in Asia Pacific region. At the same time crude oil prices have also gone thru the roof resulting in a double whammy for the consumers in India. This has given the opposition much needed impetus and fresh ammunition to target the Government. A lot has been said and written in newspapers on free fall of rupee and some of the leading economists have also shared their views on the issue. There has been lot of brouhaha and even Bharat bandh was result of this issue, but it doesn’t make much economic sense for RBI to tinker with its monitory policy or for the Government to decrease the fuel prices.

What the falling rupee combined with the global increase in prices has done is, has led to high current account deficit. CAD which was 1.9% for the quarter from Jan to March has swelled to 2.4 % of GDP mainly on account of higher crude oil prices and more imports in electronic items. Even under a benign assumption of crude oil hovers around $70 per barrel, India’s current account deficit will reach a six-year high of 2.5% of India’s gross domestic product (GDP) in 2018-19. If crude oil prices touch $90 per barrel, this could push up the current account deficit further to 3.6% of GDP.

But there is no point arresting the rupee slide by spending dollars from our foreign exchange reserves. Or reserves are touching $ 400 Billion and we are in comfortable position in that aspect but if we start using those reserves it will send a wrong signal to the foreign investors and also rupee will not attain its true value.

It doesn’t make much of an economic sense to rationalize the fuel prices as any slippage in fiscal deficit targets will set the alarm bells ringing for investors as well as rating agencies. Moody’s Investors Service (“Moody’s”) has upgraded the Government of India’s local and foreign currency issuer ratings to Baa2 from Baa3 and changed the outlook on the rating to stable from positive. India’s rating has been upgraded after a period of 13 years. Moody’s have also rightly recognized the Government’s commitment to macro stability which has led to low inflation, declining deficit and prudent external balance and Government’s fiscal consolidation programme which has resulted in a reduction of fiscal deficits from 4.5% of GDP in 2013-14 to 3.5% in 2016-17 and its consequential sobering impact on general government debt.

Even though target of this Government was to have a fiscal deficit target of 3% which was revised to 3.3% for the year 2018-19 because of increased Government spending on schemes like Ujjwala Yogna and Ayushman Bharat and increase in crude oil prices , there are further indications that there will be a slip up in this target. Also no Government wants to give on the urge to splurge especially in the election year and incumbent Government is no different. In such a scenario reverting back to the old system of controlling prices of petroleum products.

Not succumbing to the pressure so far has been one of the good decisions which Government has taken, when Petrol and diesel have already been deregulated and prices are market determined there is no point going back to the old system. Higher prices will lead to energy conservation measures and rationalization of usage which will never be achieved by keeping prices artificially low. Crude oil accounts for the biggest share in Indian imports and keeping the prices artificially low will further raise our balance of trade worsening CAD.

.

Electronic Items:

One of the major culprits in all this milieu is the electronic items and our imports of expensive cars, spare parts and Gold for which India is the largest importer. Softening of rupee will automatically raise the price of these items resulting in low growth which will automatically take care of rising current account deficit.

Boost to Exports:

Our current account balance is in negative unlike China and is ever increasing. From the low of (USD 9.9 Billion ) in Jan 17 to a high of (USD 18 Billion) USD in the month of July 18, this trend is likely to continue in the time to come if we do not increase our exports by friendly industrial policies. This CAB is likely to balloon eve further denting the confidence of investors.

Even though we are a growing economy but still our current account balance is always n negative. We always look up to china but they have a current account surplus of USD 162. 5 Billion against our Current account deficit of USD 33.5 Billion . We cannot allow this CAD to go any further. It should be our enedveaour to keep it at least with 2% of GDP by boosting our exports.

Foreign Remittances: India retained the top position as recipient of remittances with its Diaspora sending about USD 69 billion back home last year. Remittances to India picked up sharply by 9.9 per cent, reversing the previous year’s dip, but were still short of USD 70.4 billion received in 2014. This upsurge is likely to continue into 2018 on the back of stronger economic conditions in advanced economies (particularly the US) and an increase in oil prices that should have a positive impact on the GCC countries.

Based on the above arguments it is advisable not to panic and give in to the populist demand of reducing the oil prices or reigning in the rupee. On monitory front RBI is raising the interest rates, probably this is likely to continue but in the long run to become a leading economy we must target exports of USD 400 Billion and current account deficit of not more than 1.5% of GDP.

Author : Siddhartha Dua

Views expressed by the author are personal.

Image Source : Google Images

Data Source : Wikipedia , Mint, Trading Economics

No comments so far. Does that mean nobody is reading it

Great article. Loved the analysis. I think the INR is a falling knife.

Thanks Shantanu

This one has been written after lot of research. Please read and share your views.